does workers comp deduct taxes

The injury claim must be completed and. No co-pays or out of pocket.

The WCC address is.

. Workers Comp and 1099 Contractors. Will I Receive a 1099 or W-2 for Workers Compensation. Do I have to Pay Taxes on Workers Comp Benefits.

How Does Workers Comp Affect a Tax Return. Spread Payments Throughout Your Policy. While the tax court recognized the workers comp benefits as being not taxable they concluded that SSDI benefits may be includable in a taxpayers gross income pursuant to a statutory.

This ensures that you are not taxed on both amounts. Workers compensation is insurance paid by companies to provide benefits to employees who become ill or injured on the job. To qualify for a workers comp exemption business owners typically need to complete a form with their states regulatory.

We want to be your workers compensation agency. Start your workmans compensation insurance quote online or give us a call today at 888-611-7467. You are eligible for work comp the moment you start working.

No workers compensation benefits are not taxable at either the federal or the state level theyre generally. You should not receive a 1099 form. Internal Revenue Service Workers Compensation Center 400 North 8th Street Box 78 Richmond VA 23219-4838.

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. If your total monthly workers compensation benefits or your benefits plus other income are more than the maximum SSI monthly payment amount your SSI application. Discover ADPs Workers Comp Premium Payment Program Pay-By-Pay.

Just like its good practice to protect your employees and your business with workers compensation insurance. Youll want to make sure to keep track of your premium payments and include them at tax time. To discuss your legal options with a free consultation contact Rubens Kress and Mulholland.

If you need medical treatment 100 of your care needs to be paid for. If they also receive 2000 per month in workers comp payments total benefits would amount to 4200 which is 105 of the employees average current earnings. Ad No Upfront Workers Comp Insurance Premium Payment.

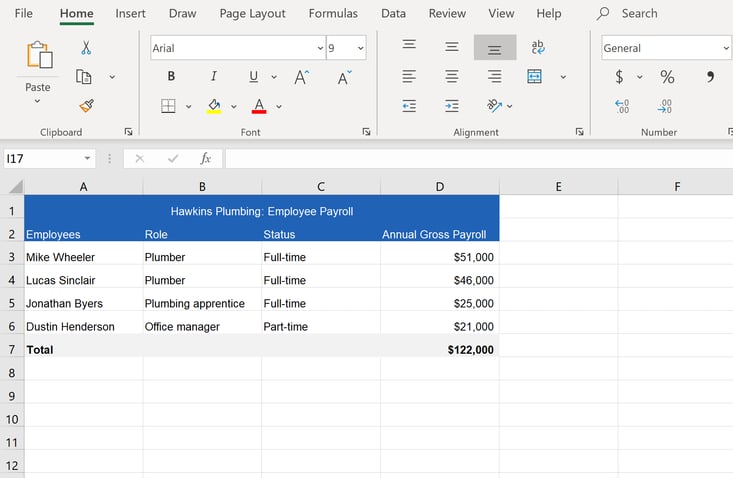

The quick answer is that generally workers compensation benefits. Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees base rate. In the eyes of the IRS workers compensation insurance is typically tax-deductible.

How to qualify for a workers comp exemption. Are taxes normally taken out of workers compensation payments. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income.

This deduction allows your workers compensation benefits to be deducted from your income. Updated on June 05 2020. We concentrate on workers compensation claims and we charge no fee unless you collect.

The short answer to this question is no taxes are not normally taken out of workers compensation. The IRS does not allow you to deduct workers comp benefits on your tax return. Here we go.

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

When Does Workers Comp Start Paying Benefits Or When They Should

Is Workers Comp Taxable An Injury Lawyer Explains

Ask About Workers Comp Gravy Trains Words Worth Prison Funny

What To Do When You Can T Afford Workers Compensation Insurance

Workers Compensation And Taxes James Scott Farrin

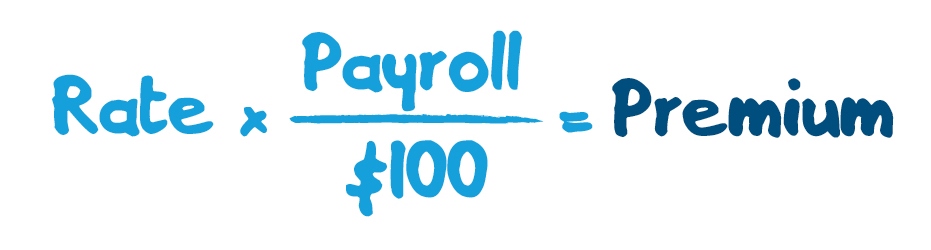

How Premiums Are Calculated Workers Compensation Board Of Manitoba

What Wages Are Subject To Workers Comp Hourly Inc

How To Calculate Workers Compensation Cost Per Employee

Is Workers Comp Taxable Workers Comp Taxes

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

Workers Comp Overpayment The Bottom Line Group

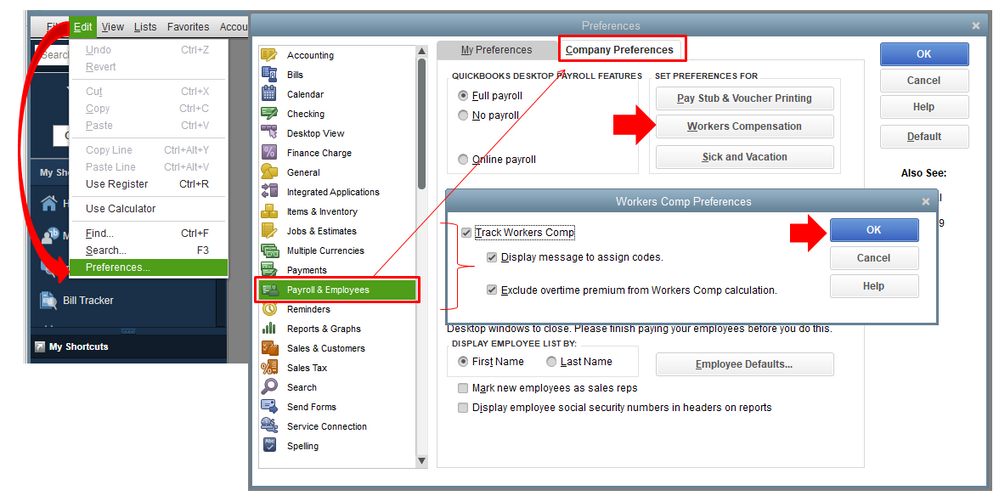

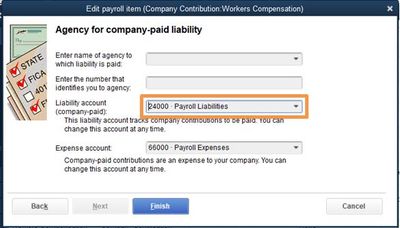

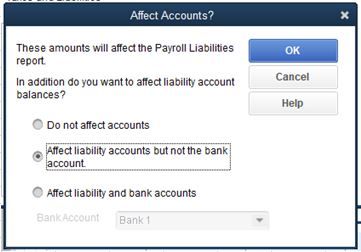

How To Adjust Workers Compensation Liability On Quickbooks Desktop Youtube