tennessee inheritance tax laws

We hope the following information provides some basic information about Tennessees. Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

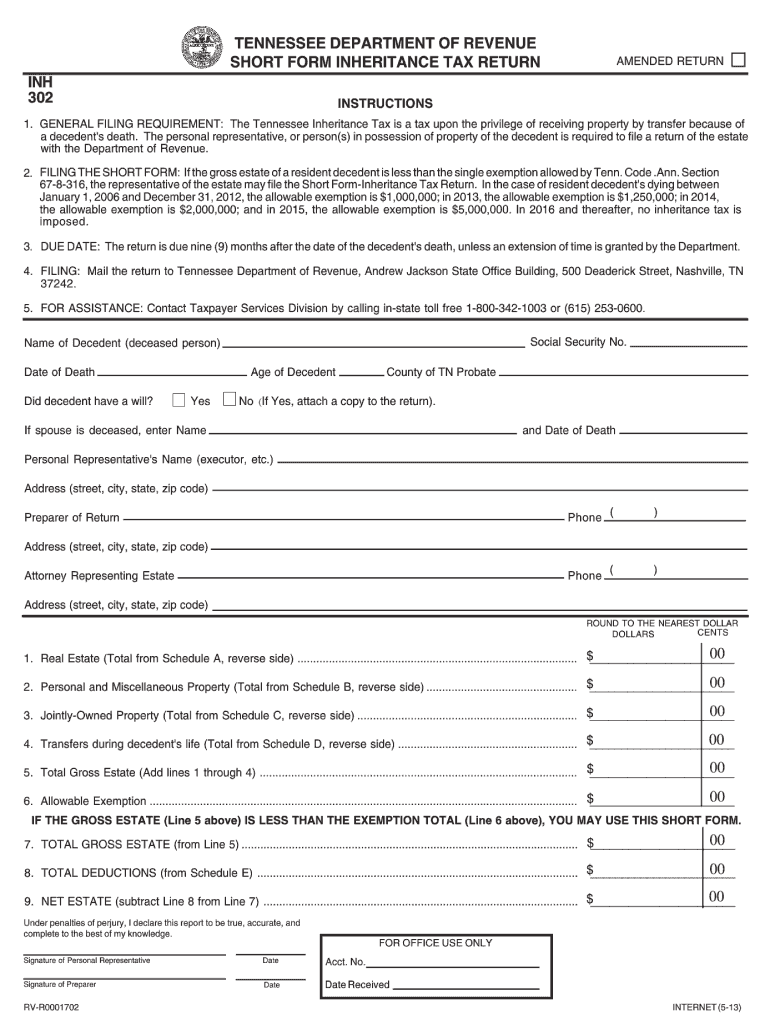

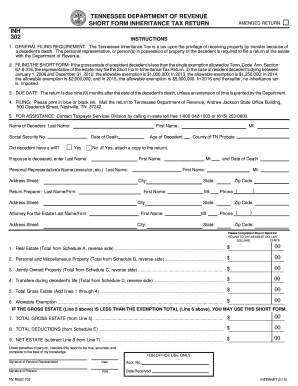

Form 302 Tn Inheritance Tax 2013 Fill Out Sign Online Dochub

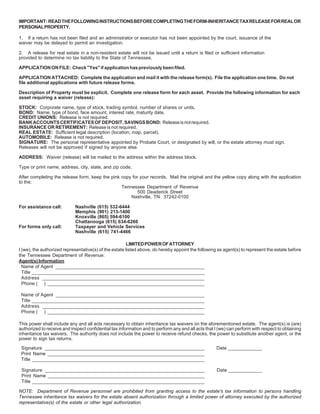

Tennessee Inheritance Tax When is the Tennessee inheritance tax due to the Tennessee Department of Revenue.

. The taxes that other states call. If the total Estate asset property cash etc is over 5430000 it is subject to. For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within.

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an. In Tennessee the intestate succession laws are. Until that time estate.

There are NO Tennessee Inheritance Tax. Info about Tennessee probate courts Tennessee estate taxes Tennessee death tax. However it applies only to the estate physically located and transferred within the state between.

Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. These are the different tax laws by state.

The good news is that Tennessee is not one of those six states. Under states that abide by community property law. This is a type of inheritance law where each spouse automatically owns half of what they each obtained while married.

Tennessee Inheritance Law. Tennessee is an inheritance tax and estate tax-free state. If the deceased persons assets are not set up with an estate plan for.

If a decedent had children but no spouse the children take everything. Technically Tennessee residents dont have to pay the inheritance tax. There are 38 states in the country that do not have an estate tax in place.

All inheritance are exempt in the State of Tennessee. Tennessee Inheritance and Gift Tax. Posted on Sep 15 2013 957PM by Attorney Jason A.

If a decedent had a spouse but no children or. The inheritance tax is different from the estate tax. As well as how to collect life insurance pay on death.

In 2016 the inheritance tax will be completely repealed. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. The inheritance tax applies to money and assets after distribution to a persons heirs.

An inheritance tax is a tax on the property you receive from the decedent. Since the Tennessee legislative code refers to both an inheritance tax and an estate tax this article refers to the death tax that is currently collected under Tennessee law as. Those who handle your estate following your death though do have some other tax returns to take care of such.

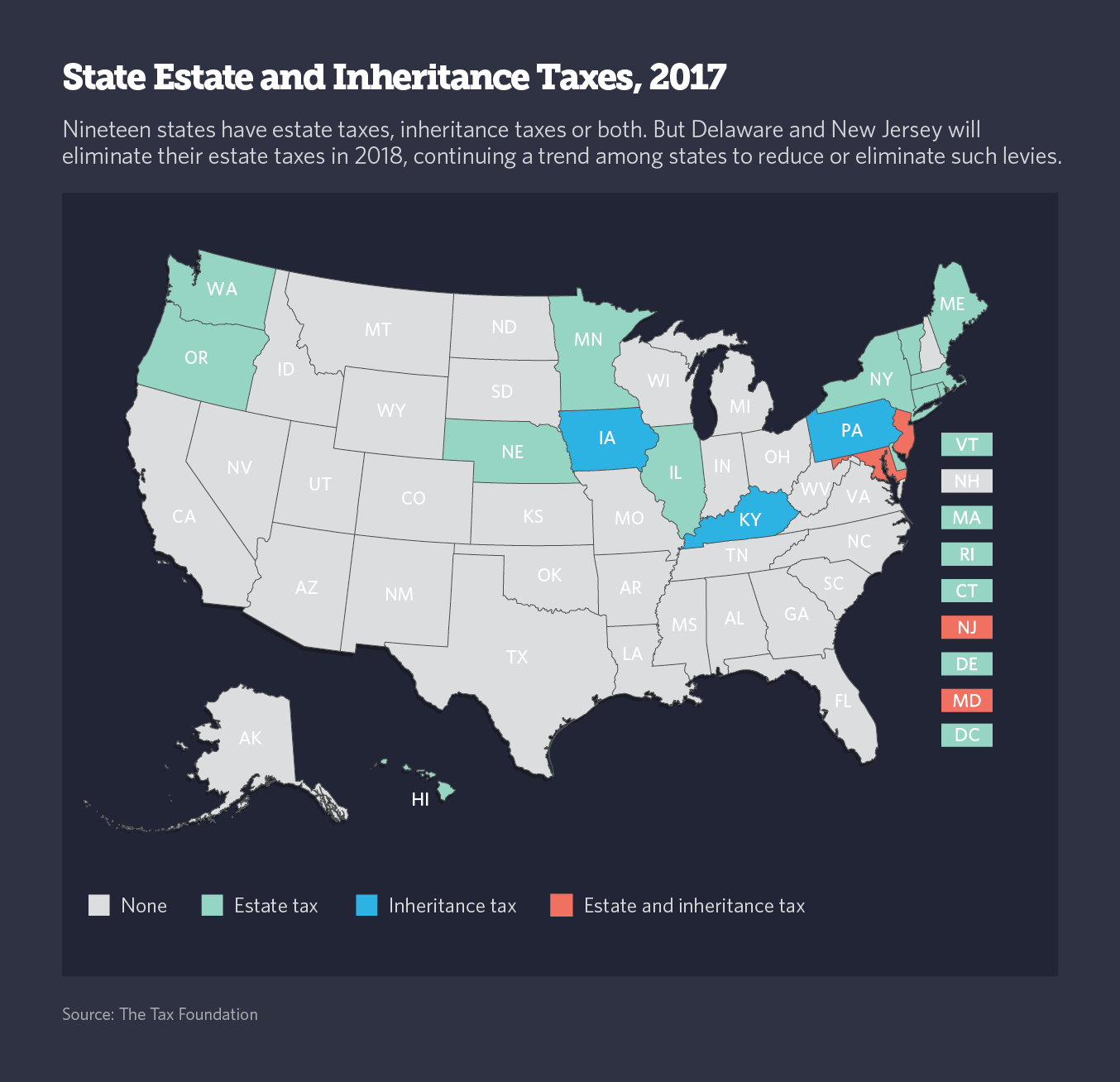

State Estate And Inheritance Taxes Itep

3 Transfer Taxes To Minimize Or Avoid In Your Estate Plan

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

State Death Tax Is A Killer The Heritage Foundation

A Guide To Tennessee Inheritance And Estate Taxes

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Estate Planning Tax Rule You Should Know Batsonnolan Com

Tennessee Probate Laws Tennessee Inheritance Advanced

Tennessee Tax Law All You Need To Know The Slaughter Law Firm

Probate Category Archives Tennessee Estate Law Blog Published By Nashville Tennessee Estate Attorneys The Higgins Firm

A Guide To Tennessee Inheritance And Estate Taxes

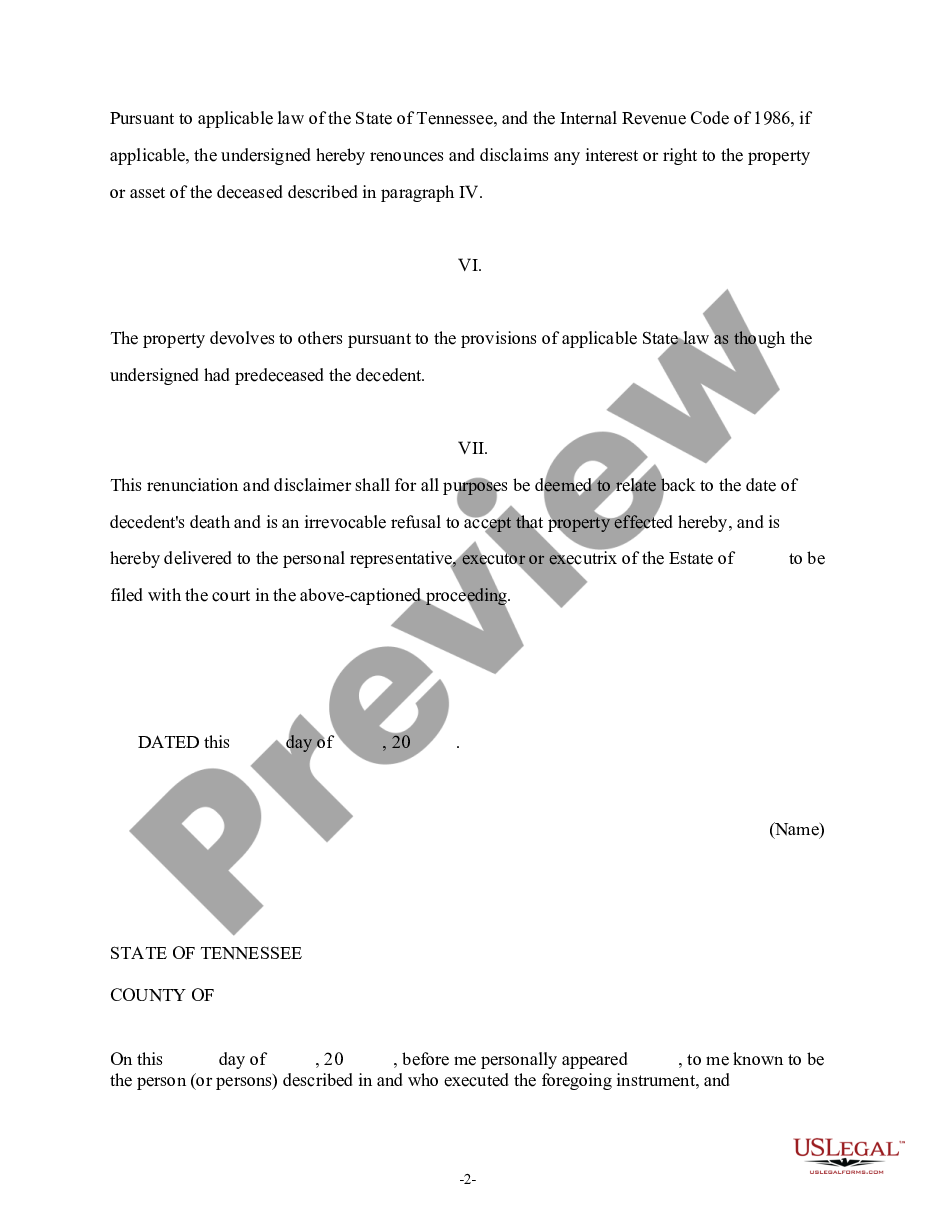

Tennessee Renunciation And Disclaimer Of Property From Will By Testate Us Legal Forms

Tennessee Inheritance Laws What You Should Know Smartasset

Form Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What You Need To Know About Tennessee Will Laws Probate Advance

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)